How to Increase ROAS for Prop Firms

Discover how prop trading firms can boost their Return on Ad Spend (ROAS) in a competitive market, going beyond Google and Meta to tap into new channels and growth opportunities.

In performance marketing, ROAS (Return on Ad Spend) measures how much revenue your ads generate compared to what you spend on them.

Simple formula, but the reality for prop firms is far more complex. Rising ad costs, stricter targeting rules, and increasing competition make it harder than ever to maintain a healthy ROAS.

In this article, we’ll unpack how to increase ROAS for prop firms, why sustaining it is becoming more challenging, and which strategies can help push it higher.

Why is ROAs so important for Prop Firms?

With the number of prop firms growing rapidly, competition for traders’ attention is heating up. As more players enter the market, ad costs are likely to rise, and ROAS will naturally decline over time.

That’s why it’s worth looking at ROAS from a more holistic perspective — as Return on Advertising. Instead of focusing only on paid ads, combine all marketing spend within a specific channel and measure the return at an aggregated level. This broader view gives a more accurate picture of how effectively your marketing budget is working for you.

Increasing ROAS for Prop Firms is about spending smarter. By focusing on the right audiences, channels, and conversion tactics, you can make every marketing dollar work harder. Here are some practical, high-impact ways to do it:

1. Apply Proven Concepts Before Trying to Reinvent the Wheel

In the marketing, it’s easy to get carried away with ideas. While creativity has its place, improving ROAS starts with execution on the fundamentals. Use proven, battle-tested acquisition strategies that already work in the trading industry. Don’t waste budget trying to “reinvent the wheel” before you’ve mastered what’s already delivering results for other prop firms. Once those foundations are in place and generating solid returns, you can layer in creative ideas to stand out. In Online Trading, the winning formula is proven concept first, innovation second.

2. Leverage Niche Websites

A listing on a Tier 1 finance site can be expensive — and may push your CPL and CPA higher than you’d like. Smaller niche platforms, especially those focused on your exact audience, can be far more cost-effective while delivering higher-quality leads. Don’t let modest traffic numbers scare you off; in today’s Zero Click era, brand mentions and backlinks can be just as valuable as direct conversions.

For example, we run proptraders.de fully organically. While overall traffic is still growing, we’re already seeing strong engagement and solid conversion rates from our audience of highly targeted traders. This proves that when the community is aligned with your offering, even a smaller site can outperform larger, more expensive placements — both in lead quality and brand visibility.

Look for platforms that own your niche and attract the exact traders you want, rather than chasing big, unfocused traffic sources.

3. Quality Over Quantity

For Prop Firms, chasing too many campaigns and ad groups at once can dilute both budget and impact. Instead of scattering spend across dozens of ad sets or channels, start with controlled testing to identify what actually works — the audiences, messages, and creatives that drive funded account sign-ups or trader engagement. Once you’ve found the winners, double down. Allocate more budget to the highest-performing campaigns, scale them gradually, and keep optimizing. This focused approach not only improves ROAS but also gives you cleaner, more reliable data to guide future decisions.

4. Target the Right Audience

One of the fastest ways to improve ROAS is to go where others aren’t. Instead of pouring budget into oversaturated markets, identify regions where competition is still low, intent is growing, and your brand can genuinely stand out.

As performance marketing expert Stanislav Galandzovskyi noted in a blog article on tradeinformer.com, “Many established regions now face two major challenges: high acquisition costs and increasing regulatory scrutiny. Emerging markets, by contrast, offer lower media costs, growing trader ecosystems, and fewer structural barriers.”

In his campaigns across 120+ regions, emerging markets like Bangladesh, Pakistan, and Indonesia consistently delivered high engagement, low CAC, and strong ROAS — proving that the right region can multiply your results.

The takeaway: focus on areas where your value proposition resonates strongly and acquisition costs remain low, then scale aggressively before the competition catches up.

5. Optimise Your Landing Pages

It sounds obvious, yet many companies still drive paid traffic to landing pages that aren’t fully mobile-friendly or ignore basic conversion best practices.

Your CTA should be clearly visible in the hero section and repeated on every fold of the page, so the user always has an easy path to conversion — whether that’s signing up for a funded challenge, joining a webinar, or downloading a trading guide. Keep the focus on one clear offer per page; don’t distract visitors with too many competing links or unrelated promotions. The goal is to guide them toward a single, measurable action.

For Prop Trading specifically, consider adding trust-building elements above the fold, such as challenge rules, quick funding timelines, payout stats, or trader testimonials. These help address objections before they arise and reduce drop-offs. A well-structured landing page doesn’t just improve conversions — it maximises the value of every click, directly boosting ROAS.

6. Properly Engage Your Customers

Acquiring a trader is just the first step — the real work begins after the first deposit. Continuous engagement is key to maximizing lifetime value and keeping traders active.

Two things matter most:

- Keep them trading. Send timely, relevant content such as market updates, trade ideas, and analysis tailored to the instruments they’ve traded before. Personalization increases both engagement and retention.

- Give them actionable insights. Develop an internal analytics and insights dashboard that shows traders their performance stats, win/loss ratios, and other key metrics that help them improve.

If building such a system in-house isn’t feasible, third-party solutions like Acuity Trading offer a turnkey way to provide rich, actionable market insights without the heavy development lift. Acuity specializes in delivering pre-packaged, high-quality analytics, news sentiment tracking, and visual market intelligence that can be easily integrated into your trading platform or client portal. These insights help traders spot opportunities, understand market drivers, and stay engaged with timely, data-backed updates.

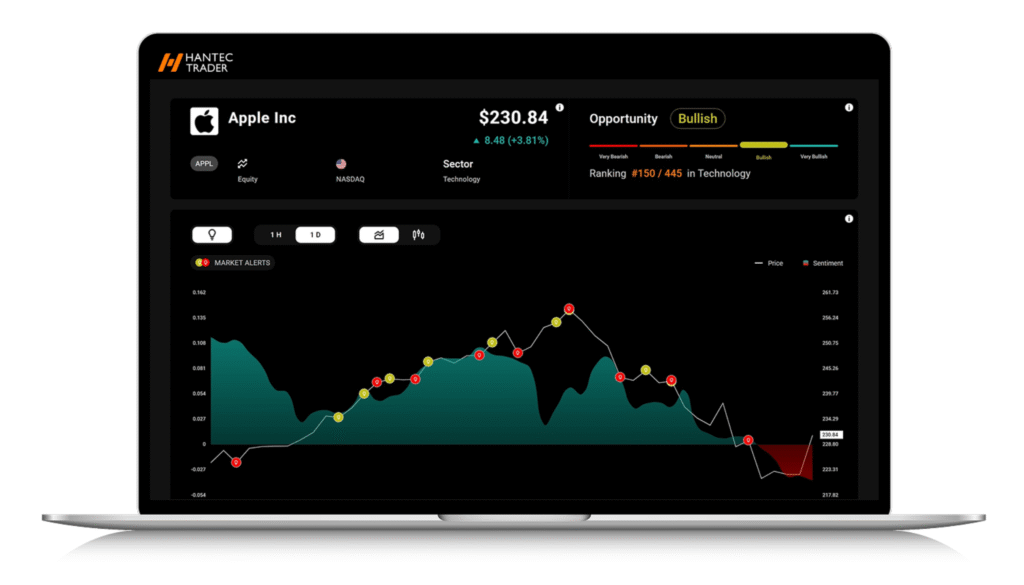

Hantec Trader is the first Prop Firms who integrated Acuity’s Trading Intelligence Dashboard

Acuity’s offering goes beyond raw data — their visual tools and sentiment indicators make complex market information accessible even for less experienced traders, while still adding value for advanced users. For example, Hantec Trader has successfully implemented Acuity’s analytics into their platform, allowing clients to quickly gauge market mood and identify potential trade setups without leaving the trading environment. This type of integration can significantly improve trader engagement and retention by turning your platform into an ongoing source of market intelligence, not just an execution venue.

7. Retargeting is a Game-Changer

Retargeting isn’t just a tactic — it’s essential, especially for Prop Firms competing in a crowded market. A research done by EmailToolTester in 2025 revealed:

- Inactive customers typically require 1–3 touchpoints before converting.

- Warm inbound leads need 5–12 touches.

- Cold prospects may need 20–50 interactions to engage.

Retargeting helps create and sustain these vital interactions, keeping your brand top of mind even when prospects disappear into dark social, hop between devices, or mask their activity with VPNs and ad blockers.

The reality is that not everything can be measured. Especially at the top of the funnel, a significant share of traffic and brand exposure will never appear in your analytics. This isn’t about abandoning a data-driven mindset — it’s about accepting that tracking gaps exist and understanding that awareness still matters. If you’re advertising on the right platforms, you sometimes have to trust that your message is reaching and influencing your audience, even if attribution data doesn’t fully prove it.

For Prop Firms, the key is to ensure traders can frequently discover your brand across multiple touchpoints — whether tracked or untracked. Every interaction, from a retargeting ad to a YouTube pre-roll or a trading forum mention, builds familiarity and trust, increasing the chances that when they’re ready to join a challenge, your firm is top of mind.

8. Tap Into New Audiences

Most Prop Firms stick to the same old channels — Meta and Google — and then wonder why their ROAS plateaus. To break through, you need to go where your competitors aren’t. Explore native advertising on platforms like Outbrain or Taboola to reach traders while they consume financial news. Partner with influencers in the trading and investing niche who can authentically promote your funded programs. Approach popular financial media sites and negotiate a dedicated Prop Trading hub or content section that positions your firm as a market leader. The point is simple: diversify your reach and you’ll uncover fresh, high-converting audiences that can fuel real ROAS growth.

Increase ROAS for Prop Firms

Maximize returns with proven Prop Trading strategies. We optimize funnels, target new audiences, and scale winning campaigns to boost your prop firm’s ROAS.

You Might Also Like

The New Generation Of Prop Traders

This article was originally published in the September 2025 edition of TRADERS magazine. The version below is an English translation…

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities…

What’s In For Prop Trading? My predictions for 2026

Prop trading is booming because it solves a problem traditional brokers can't. Beginners want to trade, but they cannot afford…

Dead Props: Over 100 Prop Firms Have Already Disappeared in 2025

Prop firms are easy to launch and often just as quick to disappear. More than 100 prop trading websites went…

The New Generation Of Prop Traders

This article was originally published in the September 2025 edition of TRADERS magazine. The version below is an English translation…

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities…

What’s In For Prop Trading? My predictions for 2026

Prop trading is booming because it solves a problem traditional brokers can't. Beginners want to trade, but they cannot afford…

Dead Props: Over 100 Prop Firms Have Already Disappeared in 2025

Prop firms are easy to launch and often just as quick to disappear. More than 100 prop trading websites went…