How Much Are Prop Trading Firms Really Paying Out?

Christian Görgen • September 16, 2025 • 5 min read

Prop trading firms have become extremely popular in the past few years. The idea is simple: you don’t need your own large trading capital to get started. Instead, you pay a fee for a trading challenge, and if you pass, you get access to a funded account. Profits are then split, often with 70–90% going to the trader and the rest kept by the firm.

This model has gained a lot of attention in particular in emerging markets. The reason is clear: payout amounts look very high compared to average monthly wages. When a firm shows traders earning several thousand dollars in a single payout, it can have a strong impact and make prop trading look like a realistic way to earn extra income or even a full-time living.

Why Payouts Are So Important in Marketing

The one number that prop firms like to highlight most is payouts. The bigger the amount they say they have paid to traders, the more serious and trustworthy they appear. For advertising, “We paid XXX million to our traders” is much easier to use than a long explanation about risk or trading rules.

There are two common ways prop firms use payouts in their marketing:

- Certificates and Screenshots

Most firms hand out payout certificates or show screenshots when a trader receives money. Traders often share these on social media, which works as free marketing for the firm and attracts new sign-ups. - Total Payout Numbers

Other firms focus on the total amount they claim to have paid out. It’s a way to show size and success and to make the firm look like a leader in the market.

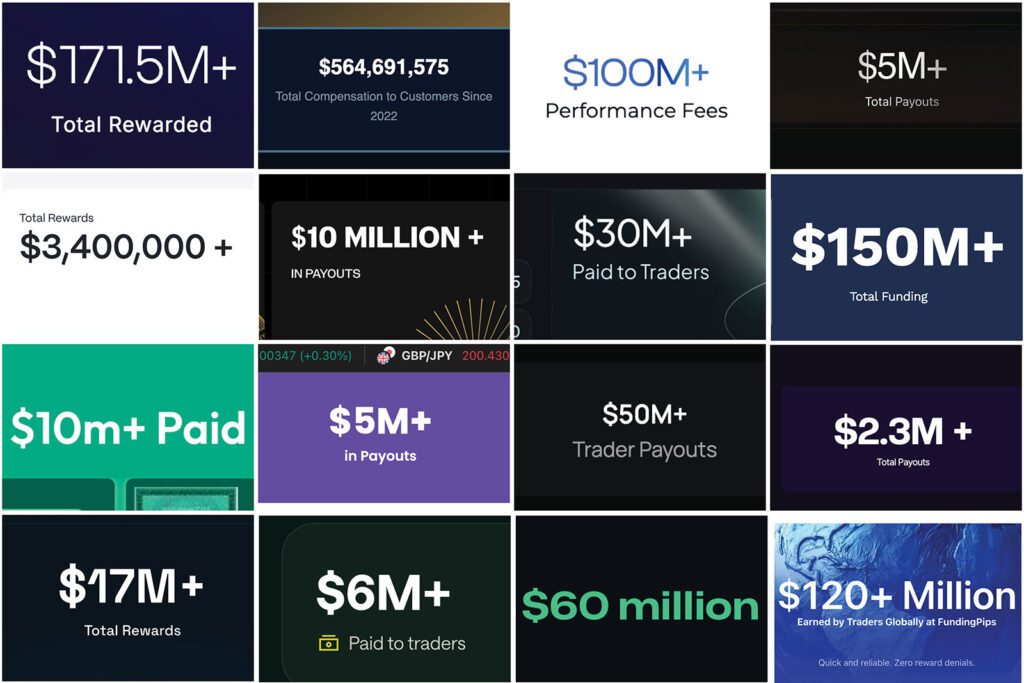

Which Firms Show Payouts on Their Homepages?

Several prop firms display total payout figures on their websites. These numbers are usually presented in large fonts or even as live counters that increase over time. The intention is to signal transparency and to provide potential traders with a sense of credibility.

Payouts are often shown alongside other trust elements, such as Trustpilot ratings or trader testimonials. Together, they are meant to demonstrate that the firm has a track record of paying out to its clients.

Payouts displayed by major prop firms (data as of 15 September 2025)

Some of the payout figures published by prop firms appear extremely high. Overall, the companies that report the largest totals are often also showing strong growth rates. At the same time, these numbers could just as well be the result of aggressive marketing strategies rather than a clear indication of trader success.

The way payouts are calculated is rarely transparent, and each firm presents them differently. In most cases, the totals are cumulative since the company’s inception, which means that older or larger firms naturally display higher figures. Without additional context, direct comparisons are nearly impossible.

| Prop Firm | Payouts shown on Homepage |

|---|---|

| Apex Trader Funding | $564,691,575 |

| FundedNext | $171,500,000 |

| Maven | $150,000,000 |

| Funding Pips | $120,000,000 |

| Alpha Capital Group | $100,000,000 |

| tradeify | $60,000,000 |

| E8 Markets | $50,000,000 |

| FXIFY | $30,000,000 |

| Blue Guardian | $17,000,000 |

| QT Funded | $10,000,000 |

| Goat Funded Traders | $10,000,000 |

| fortraders | $6,000,000 |

| Funding Traders | $5,000,000 |

| The Trading Pit | $5,000,000 |

| Aqua Funded | $3,400,000 |

No Independent Check

There is no industry body or standardized framework that verifies payout numbers. Prop firms publish these figures on their own, usually without any external oversight. What is included in the totals is not always explained, which makes it difficult to interpret them.

In the end, different payout numbers could reflect many things. Perhaps one firm really does have a customer base with more consistently profitable traders, or its challenges are structured in a way that makes reaching a payout more realistic. Looked at in a more positive light, one might even assume that some firms simply attract “better traders” than others. But it could just as easily be the case that firms are more flexible and creative in what they include under terms like “payout,” “reward,” or “funding.”

Not All Firms Publish Payouts

One interesting finding is that some of the biggest names in the industry no longer publish total payout numbers on their homepages. Instead, they have shifted towards highlighting payouts in other ways. Most still issue payout certificates to funded traders, and many post weekly summaries of their largest payouts on social media or in community updates.

What has disappeared in several cases is the prominent display of a single cumulative figure on the homepage — the kind of number that could be directly compared to competitors. Given that such comparisons are problematic anyway, this move may reflect a conscious decision to avoid misleading impressions while still showcasing trader success in other formats.

Final Thoughts

Payouts remain an important part of how prop firms present themselves. Certificates and testimonials give traders social proof, while big payout numbers are used to signal size and success. But without independent verification, these numbers should be regarded mainly as marketing claims.

For beginners, such figures can look impressive and create the impression that huge payouts are common and easy to achieve. Anyone with more trading experience, however, will read them with more caution. Knowing how difficult it is for the majority of traders to stay consistently profitable, experienced traders are more likely to question these totals — and in some cases may even see them as a red flag.

If prop trading is meant to appeal not only to newcomers but also to seasoned traders, marketing will have to be less loud and more grounded — focused on clarity, transparency, and realistic expectations rather than headline figures alone.

You Might Also Like

2nd MMG HR Summit Mediterranean to Gather Senior HR Leaders, CEOs, and Founders in Limassol

PRESS RELEASE The 2nd MMG HR Summit Mediterranean, one of the key HR and people leadership gatherings in the Mediterranean region, will…

Online Broker Hiring Report Q1/2026 – Job and Growth Trends in FX

This report analyses 1,400+ open roles across the 50 largest brokers and highlights the key hiring trends.

The New Generation Of Prop Traders

This article was originally published in the September 2025 edition of TRADERS magazine. The version below is an English translation of the…

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities for next…