Online Broker Hiring Report Q1/2026– Job and Growth Trends in FX

Christian Görgen • February 1, 2026 • 6 min read

Looking at where Online Broker Hiring is taking place offers an interesting glimpse into their growth strategies and priorities.

As part of my ongoing monitoring of the Online and CFD Trading space, I am tracking the most popular brands across a wide range of metrics, including open vacancies.

At the start of 2026, some of the leading Online Brokers have advertised more than 1400+ open vacancies globally.

In this report, I share my analysis and highlight the key hiring trends.

Key Takeaways

- Most open roles are currently advertised in Cyprus (22.8%), followed by the UAE (6%) and Malaysia (5.3%)

- IT remains the largest hiring area, accounting for 29% of all open positions globally

- This is followed by Marketing (11%), Support (11%), Partnerships (11%), and Sales (10%) vacancies

- Partner, Business Development, and Affiliate Marketing roles show particularly strong demand

- Demand for Localisation roles is mainly focused on French, Arabic, German, and Mandarin

- 12.3% of all open vacancies are advertised as Fully Remote roles

Open Roles by Country

Open Roles at Online Brokers by Department

When looking at the job titles brokers are hiring for, two clear themes stand out.

The strongest demand is for Engineering and Technology teams. This includes a large number of IT support functions, as well as data- and product-related roles.

The second major cluster is made up of business development–oriented positions, such as business developers, partner & affiliate managers, and account or relationship managers. Marketing roles appear far more fragmented and heavily segmented, while partner-focused roles tend to be less diversified and more generalised.

Most Open Roles By Job Titles

Top Online Brokers Currently Hiring in 2026

All brands in the top-10 hiring list are well-known industry players with a strong global footprint.

From a European point of view, two firms stand out because they are less visible in Europe but apparently very active in other regions. HFM currently lists around 100 open roles across all departments. Current traffic seems to come primarily from Indonesia, Japan, Malaysia, South Africa and Kenya, suggesting a strong operational focus outside Europe.

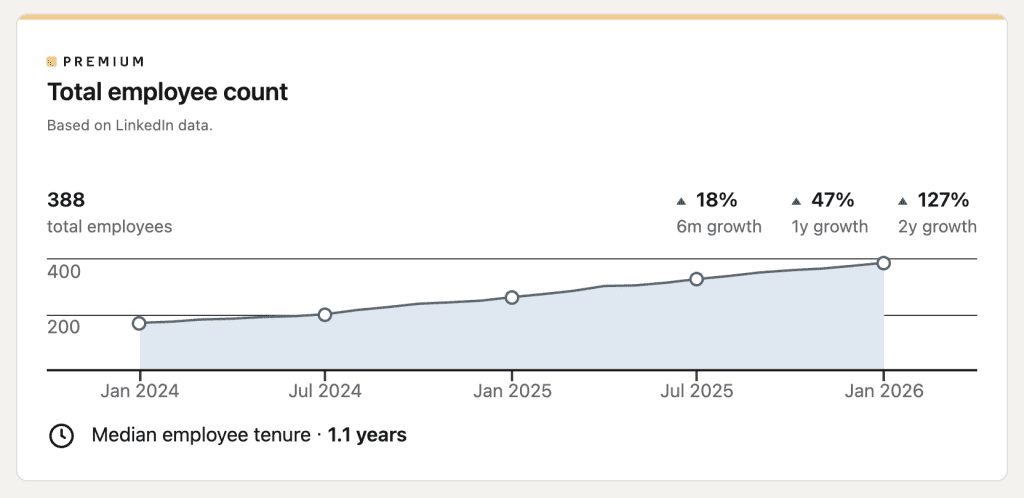

Similar picture for JustMarkets, which had 67 open positions at the time of analysis. Traffic signals point mainly to Malaysia and South Africa, alongside several other emerging markets. The pace of hiring suggests rapid expansion. At the same time, a median employee tenure of just 1.1 years raises questions about how sustainable this growth may be over the longer term.

In January 2026, the Median employee tenure at JustMarkets is 1.1 years according to LinkedIn Insights

Top Language Requirements in Job Postings

| Language | Mentions | Share of Jobs |

|---|---|---|

| English | 460 | 50.2% |

| French | 65 | 7.1% |

| Arabic | 40 | 4.4% |

| German | 39 | 4.3% |

| Mandarin | 32 | 3.5% |

| Other languages or not specified | 280 | 30.5% |

Seeing French as the 2nd in demand language seems surprising at a first glance. However, looking in the data it shows the the majority of open roles that require french speakers are from Swissquote which have a Swiss licence and Interactive Brokers who are probably primarily targeting clients from French-speaking Quebec. Other French roles are most likely targeting the African market.

Remote Jobs at Online Brokers

| Work Mode | Jobs | Share |

|---|---|---|

| Hybrid | 211 | 23.0% |

| On-site | 116 | 12.7% |

| Remote | 113 | 12.3% |

| Not specified | 476 | 52.0% |

After Covid, most companies appear to be moving back to an in-house work model. Only 12.3% of roles are fully remote, usually in cases where specific language expertise is required and hard to find in the main FX hubs. Hybrid roles account for just 23%, showing a clear trend: brokers are calling people back to the office.

Tools & Skills Mentioned Across Job Postings

Looking at tools and skills, the picture is quite tech-heavy. Engineering and IT roles tend to be more explicit about tooling. Python, Excel, and SQL stand out as the most in-demand skills.

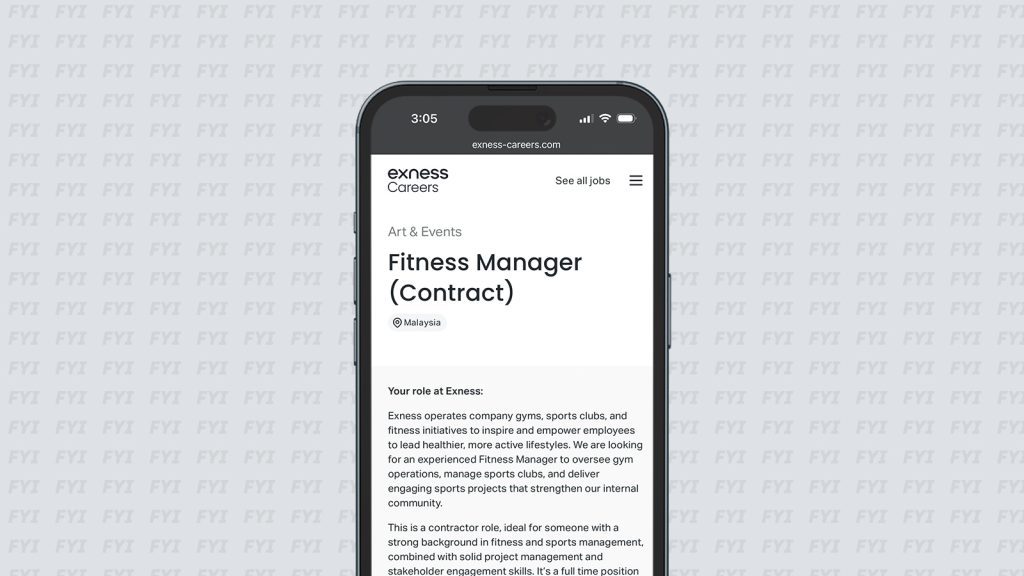

On the employer benefit side, not much exciting to report. The days where FX companies were providing housing, cars, gym memberships and more seem to be relict of the past.

Exness being the exception, seeing their cars driving all around cyprus and in Malaysia they seem to have their own gym facilities as they are hiring for a fitness instructor.

“Oversee and support employee sports clubs (planning, budgeting, supervision, and engagement)”

Most Mentioned Employee Benefits

| Benefit | Mentions | Share of Jobs |

|---|---|---|

| Medical insurance | 237 | 25.9% |

| Bonus | 194 | 21.2% |

| Competitive salary | 186 | 20.3% |

| Paid time off | 140 | 15.3% |

| Education budget | 93 | 10.2% |

| Other benefits or not mentioned | 66 | 7.1% |

Experience requirements are fairly balanced, with opportunities across all seniority levels. C-level roles are rarely advertised publicly. That said, there are currently around 40 management positions open, mostly deputy, branch, or country head roles tied to specific regions.

Experience Level Distribution

More Online Broker Hiring Trends

Salary transparency is still rare

Out of 916 job descriptions, only 21 mention any kind of salary range. Compensation is still mostly negotiated case by case and rarely communicated openly.

AI isn’t a hiring focus (yet)

Despite all the noise, AI appears in just 56 job descriptions. For most brokers, AI still looks more like a buzzword than a clearly defined, staffed function.

Pure SEO roles are disappearing

There are only 7 SEO-related roles in the entire dataset. This may point to a shift toward broader content, GEO/AI, and reputation roles — or a stronger focus on business development instead.

Methodology

Career pages and LinkedIn job listings were reviewed to identify current openings. In total, 53 online brokers are included in this report.

Across these companies, 1,430 open roles were identified, with 916 job descriptions analysed in detail.

Data collection, structuring, and analysis were supported by custom Python scripts and OpenAI-based language models. Automated scraping was combined with AI-assisted classification, aggregation, and text normalisation, alongside manual review and editing, to improve accuracy and consistency. OpenAI was used strictly for analytical support and did not generate or modify factual job data.

In cases where a single job description listed multiple locations, the role was assigned to the country in which the company’s headquarters are based.

For the purpose of this analysis, the IT category groups together all roles with a strong technology focus, including software development, engineering, data-related positions, and technical support functions.

AI Usage Transparency: OpenAI technology was used exclusively to support data processing tasks such as role classification, keyword extraction, aggregation, and consistency checks across job descriptions. All final interpretations, structuring decisions, and conclusions were reviewed manually. OpenAI outputs were treated as assistive signals, not as authoritative sources.

Disclaimer: Data was collected on 21/01/2026 and represents a snapshot of the job market at that point in time. Some companies actively restrict the use of crawlers on their websites; in these cases, data may be missing or incomplete. Hiring activity is highly dynamic, and positions may have been filled, removed, or newly opened since the data was captured. While all data has been reviewed carefully, errors or omissions cannot be fully ruled out. The primary purpose of this report is to provide a high-level overview and highlight broader hiring trends, rather than to reflect an exact count of open roles at any specific moment.