New Visitor Record! World of Trading Expo exceeds all expectations. Trading is more popular than ever in Germany.

Christian Görgen • November 11, 2025 • 8 min read

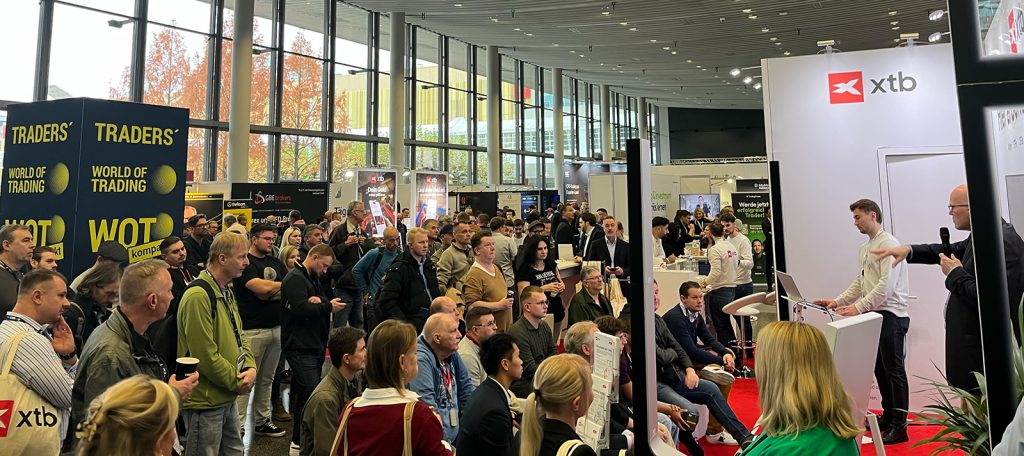

Last weekend, Germany’s most significant B2C online trading expo took place: the World of Trading in Frankfurt. For two days, Germany’s trading scene met to network and discuss all things trading. With over 6,000 visitors attending across both days, the event clearly showed one thing: retail trading in Germany is more alive than ever.

Having worked in this industry for over a decade now, I’d like to share a few personal observations and takeaways from this year’s event.

CFDs and Certificates

The German retail trading scene is still dominated by two main product categories: CFDs and certificates. These remain the go-to instruments for active traders who want exposure to leveraged products. On the expo floor, this dominance was clear: CFD brokers such as ActivTrades, Capital.com, and XTB had some of the largest booths and sponsorships.

Meanwhile, certificate issuers had their own dedicated area, hosting workshops and presentations on structured products, ETFs, and index-linked derivatives, attracting a more investment-focused audience.

Alongside these two established pillars, a third segment has been gaining ground in recent years: traders and investors using neobrokers and multi-asset platforms. This group tends to think more long-term, focusing on wealth building rather than short-term speculation – but they’re still open to calculated risks and exploring opportunities beyond traditional savings and investment products.

What Leveraged Products Are Popular in Germany?

Search interest in Germany (past 5 years)

Futures: Still a Niche in Germany

Compared to international markets, futures trading is still a niche in Germany. While traders worldwide are increasingly active on futures exchanges, the local retail market remains focused on Zertifikate and CFDs. This leaves a clear gap for brokers who specialize in futures and can make these products more accessible to everyday traders.

I believe there would be a strong potential for a modern, user-friendly futures broker to build a solid presence in the DACH region. German traders care about execution quality, ask detailed questions about broker models and order handling.

That’s exactly why futures trading could fit the German market very well. With the right platform, offering easy access to global exchanges, a broker could become the preferred choice for sophisticated traders.

I believe futures are underrepresented in Germany today, but the foundations for growth are already in place. The right mix of product quality, user experience, and local expertise could turn this niche into an exciting growth segment in the coming years.

Whselinvest Is One of the Most Popular Futures Brokers in Germany

Prop Trading: Still in Early Stages

Similar to the situation with futures trading, prop trading in Germany is still developing and hasn’t yet reached full mainstream adoption. However, the interest is clearly rising, and conversations at the World of Trading made one thing obvious. German traders are becoming increasingly curious about funded accounts and performance-based trading models.

Before the expo, I spoke with several international prop firms, and many expressed strong interest in expanding into the DACH region. The timing, being so close to the Forex Expo in Dubai, may have limited some participation, but the underlying potential remains huge. Germany is a conservative market, and trends often take a bit longer to gain traction – yet once they do, they tend to build strong, long-term momentum.

This creates a unique window of opportunity for first movers. Few firms have fully localized their offering so far, leaving room for those willing to invest in local presence, authentic communication, and partnerships on the ground.

The success of SabioTrade and ThinkCapital at the expo proved that approach works. For prop firms ready to take Germany seriously, the foundations are in place for strong and sustainable growth.

Trading Education and Strategies

One of the most positive developments this year was the growing presence of educators, traders, and coaches showcasing their services alongside brokers. From education providers and trading communities to professional mentoring, the education segment is gaining momentum and is becoming an essential part of the event.

For brokers and prop firms, this creates valuable opportunities to connect directly with educators who already have established audiences and trusted relationships with traders. Many of these collaborations can evolve into partnerships, helping both sides expand their reach and credibility.

Traders are looking for guidance, not just products, and they increasingly value brands that provide education and real value beyond the trading platform. For companies willing to engage and support the educational ecosystem, there’s a clear path to deeper, longer-term relationships with their audience.

The Exhibitors and Booths

Visitors who know expos in the MENA region, where big productions, luxury cars, and bright LED displays are common, will notice that things work differently in Germany. The atmosphere here is more reserved and business-focused. Instead of show and spectacle, the emphasis is on personal conversations and professional relationships.

For international brands that want to grow in the DACH region, local experience is key. Working with consultants, educators, or partners who understand the market helps you connect with traders in a genuine way and build long-term trust.

Your expo presence should always be part of a wider engagement strategy. In Germany, success comes from consistency, credibility, and strong relationships — not from one big event or a large budget alone.

Brokers & Prop Trading — Exhibitors at World of Trading 2025

Education & Media — Exhibitors at World of Trading 2025

Emittenten — Exhibitors at World of Trading 2025

Missing Big Names

Some of the major international brokers with an established client base in Germany, including eToro, IG, Tickmill, Trading212, and AvaTrade, were noticeably absent from this year’s expo.

Their absence likely comes down to internal changes rather than a lack of interest in the German market. Several of these firms have recently undergone management reshuffles and strategic restructuring. It seems to be more of a pause than a retreat, and it’s reasonable to expect their return in upcoming editions once new strategies are fully implemented.

On the other hand, there were several new offshore brokers taking the leap and presenting themselves to the German audience for the first time. It’s always great to see new names entering the scene, even though launching in such a competitive market can be challenging.

Retail Trading Is Booming and About to Get Even Bigger

Retail trading in Germany is more popular than ever, and the World of Trading 2025 made that clear. What started years ago as a small event for CFD and certificate traders has grown into a broad movement. New trends like prop trading, futures, and multi-asset investing are attracting more people every year. The German trading community is becoming more diverse, more experienced, and more professional.

For brokers, fintechs, and trading brands, this brings both opportunity and responsibility. The German market works differently. Local knowledge matters. Without a real understanding of the language, culture, and mindset of German traders, even big international brands can struggle to connect. That’s why working with local consultants and marketing experts is so important — they help you make smarter decisions and build the right connections.

The next big stage is already set: the World of Trading becomes Finance26, taking place on September 25–26, 2026, and expected to attract 20,000 visitors. It will be bigger, broader, and more inclusive than ever before, covering everything from trading and investing to wealth management, ETFs, and fintech innovation.

If you’re planning to be part of it, now is the time to act.

We’re already helping partners prepare the right packages, placements, and strategies for Finance26.

Get in touch now to secure your spot and make sure your brand stands out at Germany’s biggest finance event yet.

Showcase your Prop Firm, Broker, or Fintech brand at Finance26 — the leading retail trading and investing expo in Germany. Connect with traders, investors, and key industry players live in Frankfurt. Limited sponsorship slots available — save your spot now.

Request Sponsorship PackagesYou Might Also Like

2nd MMG HR Summit Mediterranean to Gather Senior HR Leaders, CEOs, and Founders in Limassol

PRESS RELEASE The 2nd MMG HR Summit Mediterranean, one of the key HR and people leadership gatherings in the Mediterranean region, will…

Online Broker Hiring Report Q1/2026 – Job and Growth Trends in FX

This report analyses 1,400+ open roles across the 50 largest brokers and highlights the key hiring trends.

The New Generation Of Prop Traders

This article was originally published in the September 2025 edition of TRADERS magazine. The version below is an English translation of the…

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities for next…