The New Generation Of Prop Traders

Christian Görgen • December 15, 2025 • 9 min read

On June 24, 2025, Funded Unicorn sent shockwaves through the German trading scene. Germany’s best-known prop trading provider unexpectedly announced its insolvency via a mass email to all customers. According to the message, losses incurred by funded traders had exhausted the company’s reserves. The insolvency marks the first major setback for prop trading in Germany.

For a long time, Funded Unicorn had been seen as a model example: a German company with a GmbH structure, transparent, education-focused, and—according to its own claims—offering real market access for its “funded traders.” Many traders followed the home bias: a German headquarters feels familiar, yet this case shows that professionalism and stability are not determined by a company’s country of origin.

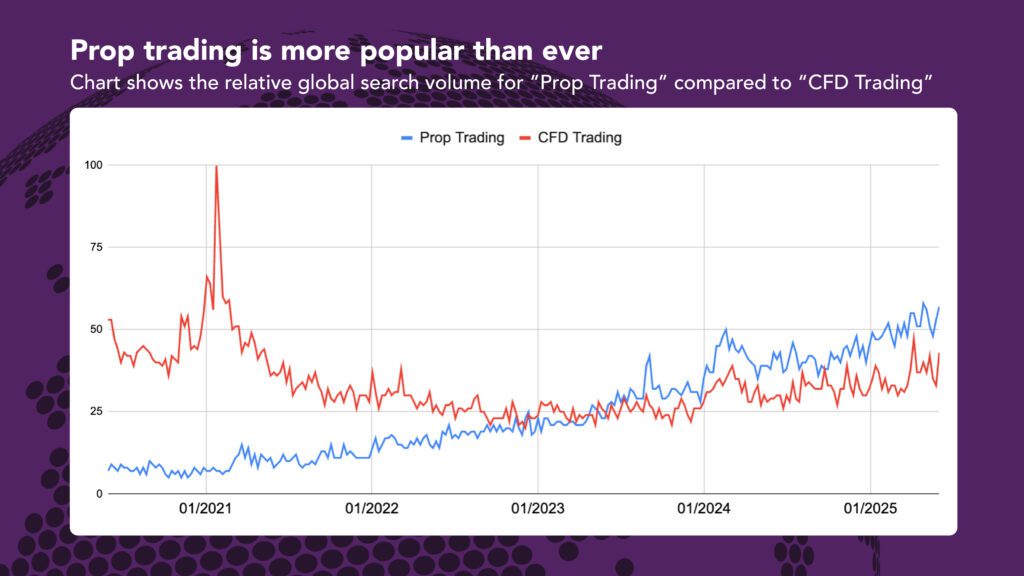

Globally, however, the prop trading boom continues unabated. Google search queries reached new record highs in 2025 and have long since surpassed interest in “CFD trading.” The appeal is particularly strong among younger traders: instead of having to commit €10,000 or more of their own capital, as is common in CFD trading, prop trading provides access to a so-called funded account. Those who pass a multi-stage challenge on demo accounts can trade with up to six-figure amounts of external capital.

What Is Prop Trading – and What’s New About It?

Prop trading—short for proprietary trading—originates from the world of large financial institutions. It refers to trading with a firm’s own capital: banks, hedge funds, or specialized companies deploy their own money to generate profits in the markets through professional traders.

What was once reserved for a small circle of professionals at banks or funds is now accessible to a much broader audience. Digital prop trading firms have opened up the model. Instead of trading internally, traders now apply through so-called challenges. Those who meet the rules—such as reaching a profit target while staying within defined risk limits—gain access to a funded account. Profits are then split, usually with 80 or 90 percent going to the trader.

Today, providers no longer come from the traditional financial sector, but from the tech and fintech space. Startups, brokers, and digital platforms are shaping the new generation of prop firms.

Why Prop Trading is trending

Prop trading strikes a chord with a new generation of traders—ambitious and digitally connected. The key factor is the relatively low barrier to entry. Those who lack sufficient capital for traditional trading but bring talent and discipline can earn access to a six-figure trading account by passing a challenge—without putting their own money at risk, aside from the challenge fees.

Compared to classic CFD trading, which typically requires at least €10,000 to €25,000 in starting capital to trade sensibly with proper risk management and position sizing, prop trading appears far more accessible. Even if a challenge is not passed, the financial loss remains manageable. Many traders view participation more as a training camp or form of education, rather than an investment with a risk of total loss.

Another factor is the strong presence on social media. On platforms such as TikTok, Instagram, or YouTube, traders share their progress in challenges, post screenshots, or provide insights into their trading setups. Prop trading has therefore become more than just a financial topic—it has evolved into part of an online culture centered on performance, visibility, and community.

And this community plays a central role: many prop firms offer internal leaderboards, Discord servers, weekly webinars, or coaching sessions. Traders are no longer sitting alone in front of their screens.

How the challenges work

Access to a funded account almost always comes through a challenge—a structured suitability test conducted on a demo account. In one or multiple stages, traders must reach a predefined profit target under simulated market conditions without breaching specific risk limits.

The rules are strict: daily and overall drawdown limits, minimum trading days, and consistent performance requirements. One-off lucky trades or high-risk maneuvers are not enough—what’s required is a disciplined, methodical trading approach.

As a result, many participants see the challenge less as a selection process and more as an intensive training program. Rulebooks, feedback, dashboards, learning materials, and community formats turn it into a kind of digital bootcamp for traders. While many retail traders tend toward impulsive behavior, a structured challenge promotes discipline, risk management, and a clean risk–reward profile.

The Dream of a „Funded Account“

Those who pass the challenge receive what many consider the true milestone in prop trading: access to a funded account. This marks the start of the next phase—the opportunity to earn real money using a trading account provided by the firm.

These accounts often start with balances ranging from $10,000 to more than $200,000, and some platforms even offer seven-figure accounts. The framework is clearly defined: profits are shared between the trader and the firm, typically with 70 to 90 percent going to the trader. Losses, on the other hand, are borne exclusively by the provider. The prop trader therefore has no personal capital at risk and is effectively trading with “other people’s money”—as long as the rules are followed.

These rules continue to apply even after the challenge. They include strict drawdown limits, maximum daily or total losses, and often restrictions on trading style or holding periods. Violating them can result in the loss of the funded account—regardless of how much profit has already been made.

The Downsides

As fascinating as the model is, it also has its dark sides. The biggest criticism: many prop trading firms do not primarily make money from successful traders, but from those who fail. Challenge fees—often between €100 and €500—represent the main source of revenue for many providers.

In addition, some platforms rely on aggressive marketing, offer paid add-ons such as coaching programs, express upgrades, or retakes, and thus create an ecosystem heavily focused on monetization. Not all rules are transparent, not every evaluation is easy to understand, and not every firm has stable financial or technical structures.

This does not mean the model is fundamentally illegitimate—but it does show how important it is to take a closer look. Not every prop trading firm pursues sustainable, long-term goals. And not every trader is well advised to jump into the next challenge without careful consideration.

How Can You Identify a Reputable Provider?

In a growing and still largely unregulated market, many traders ask themselves: who can I trust? The answer lies in the details—in the rules, the support, and the level of transparency.

Reputable prop firms are characterized by clearly defined terms and conditions. Rules on drawdown, profit targets, and trading restrictions should be communicated openly, documented in a way that is easy to understand, and applied consistently. The payout policy is another decisive factor: How quickly are payouts made? What conditions must be met? Are there verifiable testimonials from traders who have actually been paid?

One often underestimated point is the question of who is behind the offer. Many prop firms are backed by established brokers with a regulated background. These firms have infrastructure, liquidity, and capital—and are therefore able to process payouts reliably. Such providers are generally more resilient than small startups without financial backing.

Equally important is the underlying business model.

- A-book firms route traders’ orders directly to the market. They earn money from successful traders—or potentially bear losses, as allegedly happened in the case of Funded Unicorn.

- B-book firms typically operate entirely in a simulated environment, without real market access. Performance is evaluated internally, sometimes partially hedged, and profits are generated primarily from challenge fees.

Both models are legitimate—as long as they are disclosed transparently and expectations are clearly set.

Germany’s Gray Zone

For German traders, the question is not only about choosing the right provider, but also about their own role: am I a customer, an entrepreneur, or something in between? Anyone who receives a funded account from an international prop firm and trades regularly operates in a legal gray area that is still poorly defined.

What is clear is that, in Germany, there is currently no specific regulation for prop traders operating via foreign platforms. What remains unclear, however, is how the resulting income should be treated for tax purposes. Is it considered capital gains? Or commercial income that requires registration with the tax authorities? Could there even be a risk of false self-employment?

Depending on the structure of the contract, the payout mechanism, and the actual activity, the legal assessment can vary significantly. Many tax advisors themselves are facing unanswered questions here—especially since the legal framework could change quickly as the market continues to grow.

One thing is certain: anyone trading successfully over the long term and receiving regular payouts should consult a tax advisor early on. Even if the legal situation is currently vague, tax authorities are paying closer attention.

In the long run, it is likely that legislators will respond. The industry is growing, revenues are rising—and with them, the interest of regulators and tax institutions. Prop trading in Germany is (still) a gray zone. But that could change soon—and arguably in the interest of all parties involved.

What Remains of the Trend?

Prop trading is more than a short-term hype. For many, it represents the first serious entry into the world of professional trading—with clear rules, realistic pressure, and the opportunity to take responsibility in the markets without using personal capital. Especially for young, ambitious traders, a new playing field is opening up—one that was previously reserved for institutional players.

For the model to remain viable in the long term, however, more than growth is needed. Professionalization must continue—on both sides. Providers need to make their business models more transparent, stable, and sustainable. Traders, in turn, should not be blinded by the promise of quick money, but see prop trading for what it can be: a school for discipline, risk management, and strategic thinking.

Where education, community, and a performance-driven culture come together, real value is created. The best providers do not just fund traders—they develop them. And that is where the true potential lies: with the right framework, prop trading could establish itself as a permanent part of the trading landscape—not as a replacement for traditional broker models, but as a complementary path for those willing to perform.

About Proptraders.de

Proptraders.de is the largest comparison portal for prop trading in German-speaking countries. With over 200 listed providers, the platform offers a transparent overview of various challenges, models, and conditions—and helps you find the right prop firm.

“Die neue Generation der Prop Trader” was published in the September 2025 issue of TRADERS magazine.

Buy the September IssueYou Might Also Like

Online Broker Hiring Report Q1/2026 – Job and Growth Trends in FX

This report analyses 1,400+ open roles across the 50 largest brokers and highlights the key hiring trends.

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities for next…

What’s In For Prop Trading? My predictions for 2026

Prop trading is booming because it solves a problem traditional brokers can't. Beginners want to trade, but they cannot afford to lose…

Dead Props: Over 100 Prop Firms Have Already Disappeared in 2025

Prop firms are easy to launch and often just as quick to disappear. More than 100 prop trading websites went offline or…