Why Do Chief Marketing Officers Have Such Short Tenures in Online Trading?

Christian Görgen • July 13, 2025 • 11 min read

In the fast-paced world of online trading, Chief Marketing Officers rarely stay in their roles for long. But why is it so hard to survive as a marketing leader in the CFD industry? We wanted to find out — so we looked into the data and ran our own research.

What we found was striking: the median tenure for Chief Marketing Officers in the online trading space is just 17.5 months. That’s less than a year and a half to deliver results. It says a lot about the pressure marketing leaders face in this business.

Expectations are high. Founders want rapid user growth and quick revenue, often within months. But marketing isn’t something you can switch on overnight. Building trust and driving sustainable growth takes time. No wonder many CMOs find themselves out the door before they can even make a real impact.

In this article, we take a closer look at why marketing leaders struggle to stay in their roles — and what this reveals about the culture and expectations within the online trading industry.

How We Conducted This Research

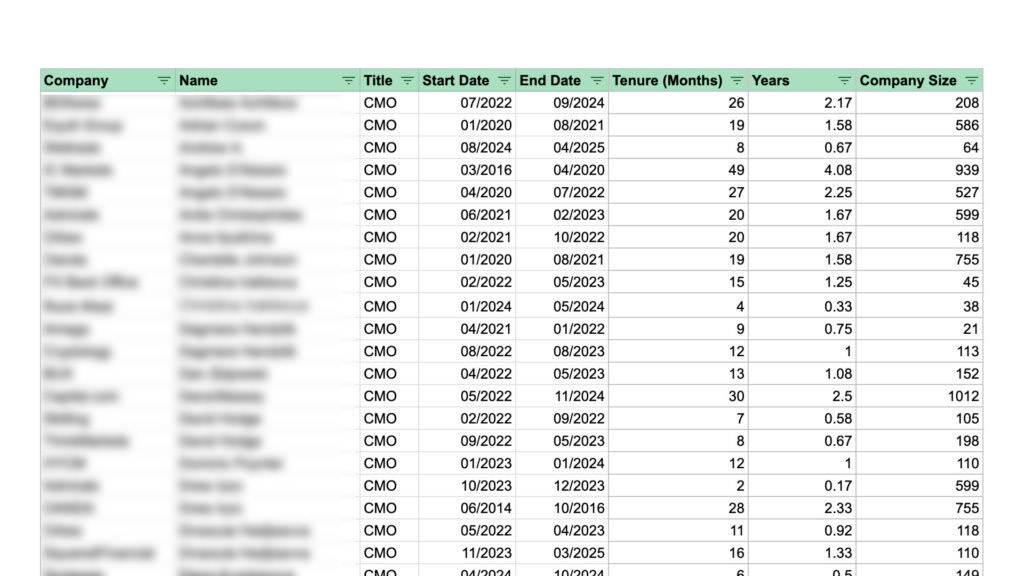

In total, we analysed 50 data points from 2014 until today. Our study covered 40 individual CMOs across 38 companies in the CFD and online trading space — primarily brokers, with a few B2B service providers included as well. To get a well-rounded view of tenure trends across the sector, we also included a mix of company sizes.

- LinkedIn profiles: We reviewed public profiles to identify job titles, start dates and end dates.

- Industry news websites: We cross-checked data against industry sources like TradeInformer, Finance Magnates and LeapRate.

- Public announcements: We investigated official press releases and personal posts announcing new roles or exits.

Our aim was to understand how long CMOs usually stay in these roles, why it’s so hard for them to last long-term and what this says about leadership and marketing in the online trading industry.

Data Snapshot: Company and individual names have been blurred for privacy.

Disclaimer: The information we used is based on publicly available LinkedIn profiles, which may not always reflect exact timelines. Some individuals may keep outdated titles until a new position is confirmed, or present their experience in the most favourable light. We didn’t adjust for these nuances — but it’s worth noting that in some cases, the actual time in role may have been even shorter than what appears.

Overall Chief Marketing Officer Tenure Trends in Online Trading

- Median tenure: Chief Marketing Officers in the online trading industry have a median tenure of 17.5 months – less than 1 and 1/2 years.

- Average tenure: The average tenure is 22.4 months (1.87 years), with a few longer-term roles contributing to a slightly higher overall figure.

- Short tenures are common: 19 out of 50 CMOs stay less than one year.

- Few long-term stays: Only 2 out of 50 CMOs remained in their roles for five years or more.

- Many positions remain vacant: In several cases, companies did not rehire for the CMO role after the previous CMO left.

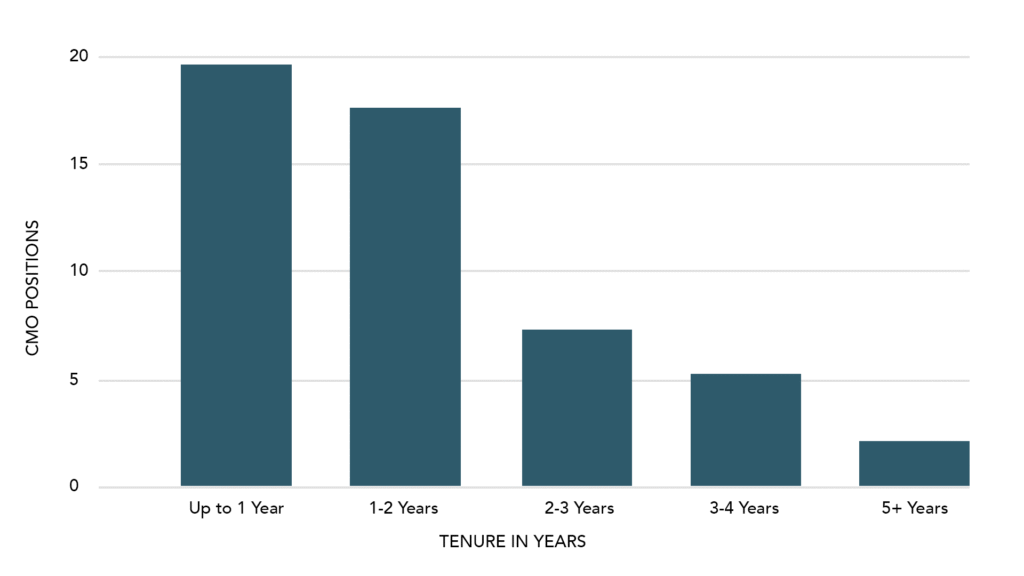

Breakdown of Chief Marketing Officer Tenure Durations in Online Trading

| Chief Marketing Officer Tenure Duration | Number of Chief Marketing Officers |

| Up to 1 year | 19 |

| 1 to 2 years | 17 |

| 2 to 3 years | 7 |

| 3 to 4 years | 5 |

| 5 years or more | 2 |

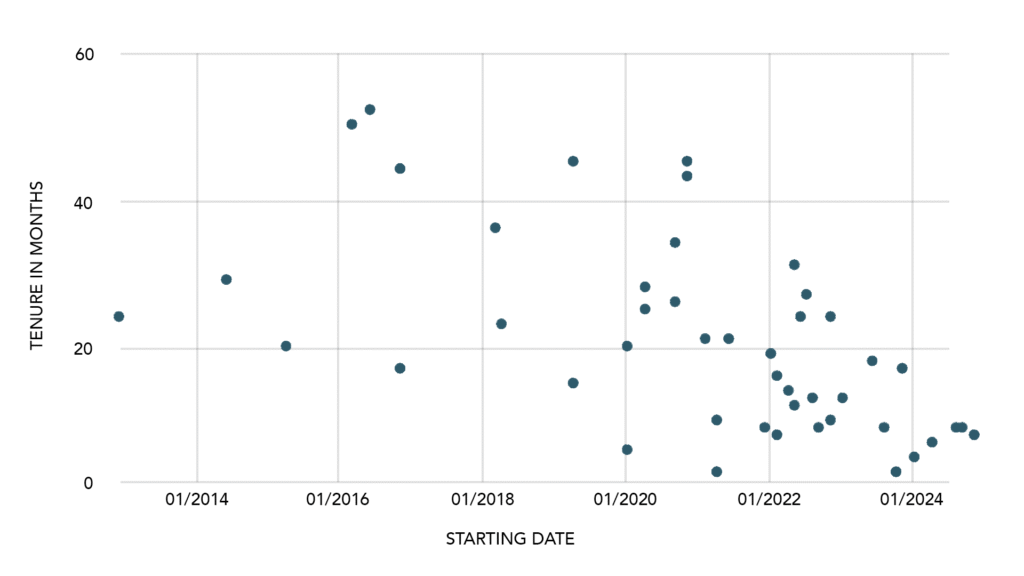

Chief Marketing Officer Tenure Hits Record Low in 2024

Tenure hasn’t been increasing: it has continued to decrease over the years, with 2024 showing the lowest average tenure in the entire dataset.

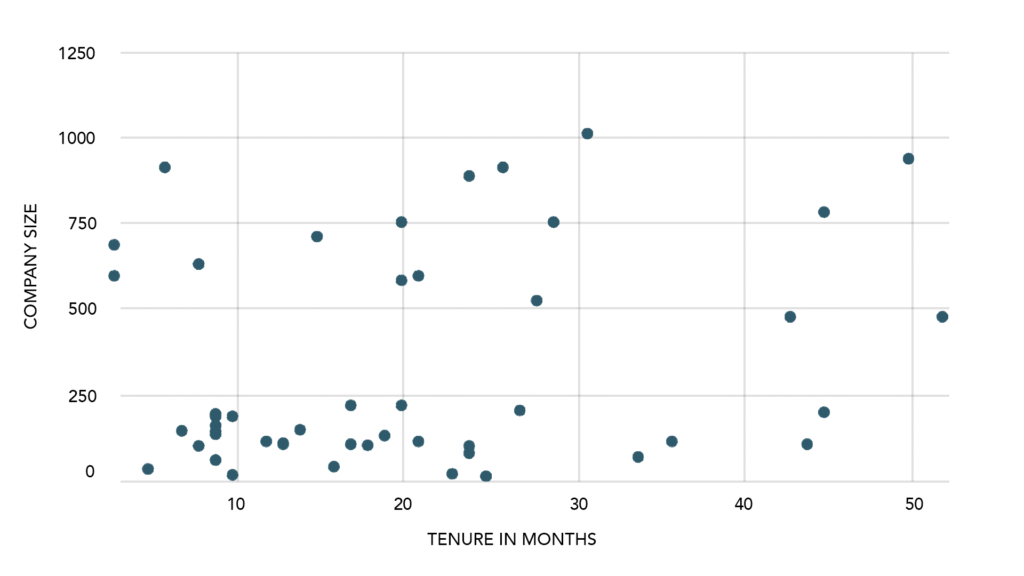

No Link Between Broker Size and Chief Marketing Officer Turnover

There is no correlation between company size and Chief Marketing Officer tenure. Both large brokers and smaller firms see similar turnover rates.

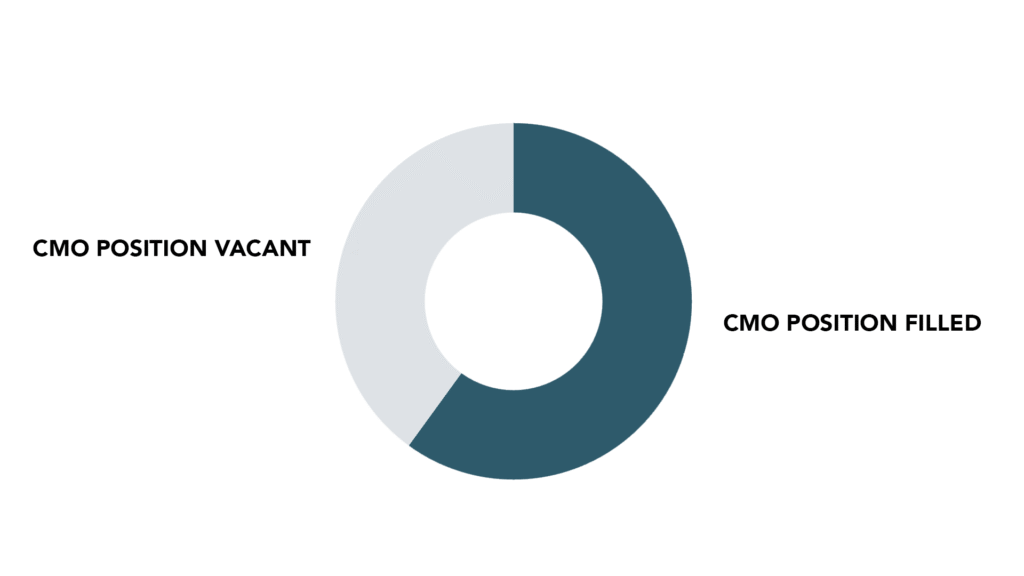

Companies That Did Not Refill the Chief Marketing Officer Role

Another striking finding: 40% of the brokers we analysed currently have no CMO in place following the departure of the previous one.

Out of the 40 brokers investigated, 16 had no one holding the official Chief Marketing Officer title at the time of review. Whether this is due to strategic decisions, contractual arrangements, or unfilled vacancies is unclear based on available data.

It is important to note that this analysis focused specifically on the CMO title. Other senior marketing roles, such as VP Marketing, Marketing Director, or Head of Marketing, were not included. This means that while many brokers may have senior marketers in place, they do not formally appoint them as C-level executives.

CMO Tenure in Online Trading: Key Insights

We analyzed 50 data points across 38 brokers to understand how long CMOs really stay in online trading — and why so many exit early.

Why CMOs Struggle: An Industry Built Differently

What does this data really tell us about the industry?

Part of the answer lies in the DNA of online brokers and why they’re founded in the first place. With some exceptions, these businesses aren’t product-driven.

Unlike tech founders who invent solutions to real problems, many trading brands build on existing models that have worked before. They focus less on innovation and more on capturing revenue through proven frameworks.

Tech startup founders obsess over metrics like Digital Journey Conversion Rates, DAU/MAU Ratios and NPS Scores. In contrast, CFD brokers often prioritise traditional financial KPIs – metrics like CPA, Net Deposits and Lifetime Customer Value. This focus shapes how marketing is viewed within the organisation.

What’s often overlooked is that marketing success isn’t something you can switch on overnight. It requires calibrated systems where strategy, tech stack and team execution all align to move those financial KPIs.

Even with the right strategy and execution, external factors remain outside a CMO’s control. Market conditions, legacy tech issues, or inherited team challenges can stall progress, no matter how strong the marketing approach.

The Problem: What’s There to Work With?

Working in Forex means competing in a crowded market. In Cyprus alone, CySEC lists 247 approved domains as of July 2025 — and let’s be honest, most of them offer pretty much the same: multi-asset access, fast execution, tight spreads and multilingual support.

Can You Match the Slogan? Top Headlines from 4 Major CFD Broker Websites

That’s what makes marketing in this space so challenging. There’s often nothing unique to build on. No strong brand story. No emotional hook that genuinely connects with traders. Most Forex firms stick to generic promises without communicating anything that truly sets them apart.

For CMOs, this makes the job hard from the start. Without anything unique to offer, marketing just ends up repeating what everyone else is doing instead of creating something traders actually care about.

Why Forex Marketing Stays Stuck

In Forex marketing, not much ever changes. Most brokers rely on the same old playbook – daily market updates with low impact, generic product-focused social posts designed to drive traffic to their websites and unsegmented email blasts.

Performance marketing and affiliates remain their safe haven – the familiar channels they cling to, even when real growth requires more.

Performance marketing only captures existing demand – people who are already looking to trade. It works well when markets are active, but becomes almost useless when things slow down. Instead of focusing on building their brand or reaching new audiences, brokers keep chasing quick ROAS. If new ideas don’t deliver results immediately, they’re dropped, killing any chance for real innovation.

Creating demand is a different game altogether. It’s about reaching people who don’t yet know they want to trade. That means building trust and giving traders a reason to choose you – by creating a brand with an irresistible vibe, leading the way in technical innovation and positioning yourself as bold and avant-garde within the trading community.

Very few brokers manage to achieve this.

Affiliate Marketing or Ponzi Scheme?

To make things worse, affiliate marketing dominates the channel mix. Brokers often give away 25% to over 50% of their revenue to affiliates and introducing brokers. While some affiliates deliver real value, the darker side is rarely discussed: fake traffic, shady referrals and recycled client books.

It often ends up feeling like a pyramid scheme. Affiliates leave the moment the illusion fades — or they find a better deal elsewhere. In the affiliate world, this is known as “broker hopping”. The cycle repeats, and the broker remains locked in a constant race to find new partners, never truly owning the customer relationship.

Too often, it seems like brokers avoid building their own marketing capabilities, choosing instead the path of least resistance: outsourcing growth to affiliates. The irony? They’re willing to give away half their revenue to third parties but won’t invest even a fraction of in long-term, sustainable growth.

Just like in trading — if you’re not willing to take calculated risks and try new strategies, you’ll never see real returns.

The Chief Marketing Officer Position in Online Trading:

A Big Miss-Understanding

In the world of online trading, the Chief Marketing Officer role is often fundamentally misunderstood. Founders and C-level executives typically bring in a CMO when acquisition metrics start to decline. When leads slow down and growth stops, leaders look for someone to fix it fast. The assumption is that a CMO will come in and quickly turn things around to restore momentum.

At the same time, many CMOs step into these roles with their own misconceptions about what is needed. Coming from other industries, they often apply the same approaches that worked for them before. They invest heavily in rebranding, changing logos, refreshing colours and a new website. This is often followed by a huge branding campaign, supported by expensive media buys to raise awareness fast.

However, in Forex, these initiatives rarely align with what leadership actually expects — fast, visible results. Rebrands and campaigns take time to gain traction, but founders are often impatient. Without a clear USP or real differentiation to promote, even the most polished campaigns struggle to deliver immediate impact.

As results fail to meet expectations, CEOs and founders quickly become impatient. Budgets are reduced, priorities shift and the Chief Marketing Officer soon finds themselves with limited support and even fewer options. Before long, they are moved on – another marketing leader exiting the industry without having made the impact they intended.

Successful CMOs Are More Ops Than Marketing

CMOs in this industry are often brought in with vague mandates to “fix marketing” and many apply strategies from other sectors that usually work fine. But in the world of Forex and CFDs, those playbooks rarely work. When results fall short, support fades — and within months, the CMO is out. Meanwhile, the real challenges around acquisition, positioning, and differentiation remain unresolved.

Worse still, these failed attempts often lead C-level teams to question whether the CMO role makes sense in this business at all.

The reality is, the marketing leaders who do succeed in online trading are rarely traditional CMOs with creative backgrounds. Instead, they tend to be hands-on, highly technical, and closely aligned with the trading side of the business. Many even come from within the company, stepping up from other roles. Their backgrounds are often in business, computer science, or trading — not media, design, or brand marketing. They follow structured frameworks, focus on execution, and know when to turn up the volume.

The Way Forward: Rethinking Marketing Leadership

The traditional Chief Marketing Officer model isn’t working in online trading. If the industry wants different results, it needs to think differently. Founders must move away from relying purely on performance marketing and affiliates, and start focusing on creating real demand and building brands that truly stand out.

This starts with giving marketing a proper seat at the table. It shouldn’t be treated as a support function or a last resort when growth stalls. Marketing needs to be part of the core business strategy, working alongside Product and Sales to create offers that resonate and drive meaningful growth.

Transform How You Approach Marketing

At FYI, we combine deep industry knowledge with hands-on execution, backed by a network of specialists and partners who focus on what actually drives results.

We believe marketing shouldn’t exist in a silo. Real impact happens when it’s fully integrated across product, sales, operations and brand. That’s why we build 360-degree strategies that are holistic, performance-driven, and organic-first at their core.

If you’re in Forex, Prop Trading or FinTech and ready to commit to sustainable marketing — let’s talk.

You Might Also Like

2nd MMG HR Summit Mediterranean to Gather Senior HR Leaders, CEOs, and Founders in Limassol

PRESS RELEASE The 2nd MMG HR Summit Mediterranean, one of the key HR and people leadership gatherings in the Mediterranean region, will…

Online Broker Hiring Report Q1/2026 – Job and Growth Trends in FX

This report analyses 1,400+ open roles across the 50 largest brokers and highlights the key hiring trends.

The New Generation Of Prop Traders

This article was originally published in the September 2025 edition of TRADERS magazine. The version below is an English translation of the…

Marketing Budget Allocation 2026

With 2026 approaching quickly, now is the time as an Online Broker or Prop Firm to set your marketing priorities for next…